Let customers pay in instalments, while you get paid in full. More options for them. More sales for you.

Your customers pay in

weekly interest-free instalments.

You get paid in full

as soon as the next business day.

BNPL by the numbers.

Offering By Now Pay Later payment options can help boost your sales and attract valuable customers – at no risk to your business.

55%

of Gen Z (9 – 24) have used a BNPL service in the last 6 months (01 April 2023).

52%

of Gen Y (25 – 40) have used a BNPL service in the last 6 months (01 April 2023).

+37%

of Gen X (41 – 56) have used a BNPL service in the last 6 months (01 April 2023).

+15%

of Boomers (57 – 75) have used a BNPL service in the last 6 months (01 April 2023).

Source: Finder’s CST, a monthly survey of around 1,000 Australian adults.

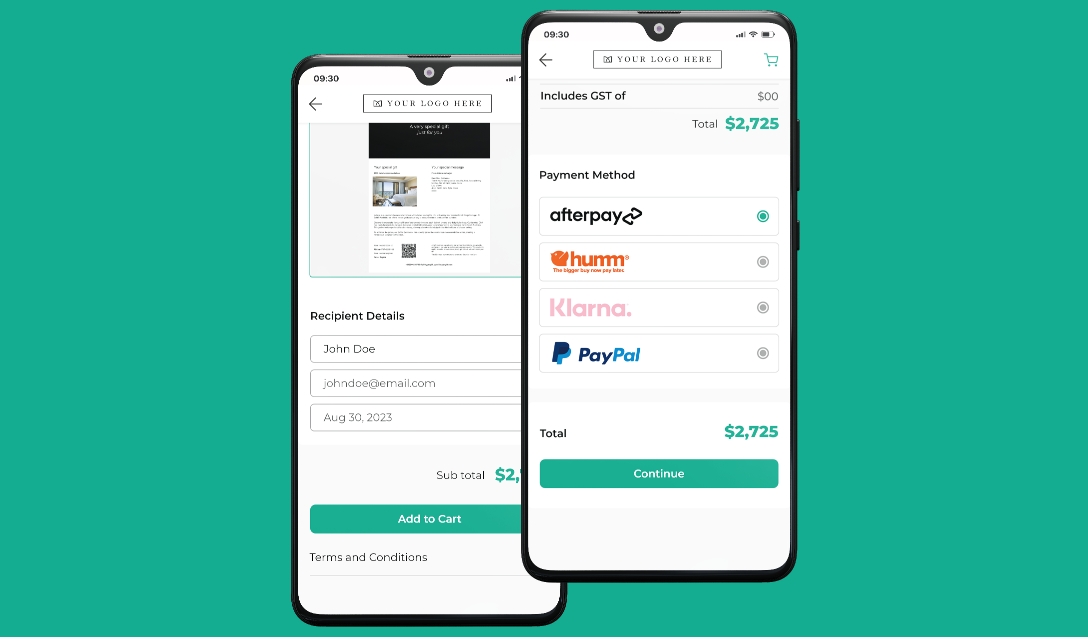

Choose your providers.

HyperGift® seamlessly integrates with your preferred BNPL service providers, allowing you the flexibility to utilise a single provider or multiple options based on your preferences.

16M

Users

2.7M

Users

150M

Users

435M

Users

16M

Users

2.7M

Users

150M

Users

435M

Users

Getting started is easy.

1. Establish your BNPL business account(s), if not already done.

2. Load your account(s) into HyperGift®.

3. Launch into a new realm of payment acceptance and generate more revenue!

When you’re ready to integrate your account(s) into the HyperGift® solution, simply notify erica@omnihyper.com. We’ll swiftly transition you to the live stage, completely free of charge.

FAQ

How does buy now, pay later work?

Buy now, pay later, or BNPL, is a payment option where a customer pays for a purchase over time in instalments, while merchants get paid in full.

How do I set up buy now, pay later?

Enabling the buy now, pay later payment method is accessible for numerous businesses. If you are already associated with an existing provider, HyperGift® can seamlessly integrate with your current setup.

In the absence of an account with an existing provider, we advise conducting thorough research to identify the most suitable provider for your needs. Reputable options include Afterpay (Clearpay in the UK), Humm, Klarna and PayPal Pay in 4.

How much does buy now, pay later cost?

When utilising BNPL services, businesses typically receive the full payment at the time of purchase, with a deduction for a processing fee based on the total order amount. This processing fee is typically a small percentage per transaction, accompanied by a nominal transaction fee.

What about fraud and chargebacks on buy now, pay later payments?

BNPL platforms are generally setup to take on the risk of customer fraud for you so you can focus on growing your business. You will receive the full payment and at no risk to your business.

What if I don't want to offer buy now, pay later to my customers?

If you prefer not to provide the buy now, pay later option to your customers, rest assured that BNPL is an optional payment method made available by HyperGift®. By default, this feature is deactivated, and it will only be activated based on your explicit instructions and preferences.

How do refunds work with buy now, pay later?

If a customer requests a refund, and you approve the refund, they are entitled to a full reimbursement of their payment. For comprehensive information regarding refund processes, it is advisable to consult your chosen BNPL service provider, as their specific refund policies and procedures will apply.